Risk Participation

In FinShare, Risk Participation allows banks to manage transactions effectively. The Bank assumes a defined portion of the credit risk of a transaction originated by another Lead Bank. This ensures efficient collaboration among all parties involved in the financing process.

Book a Demo

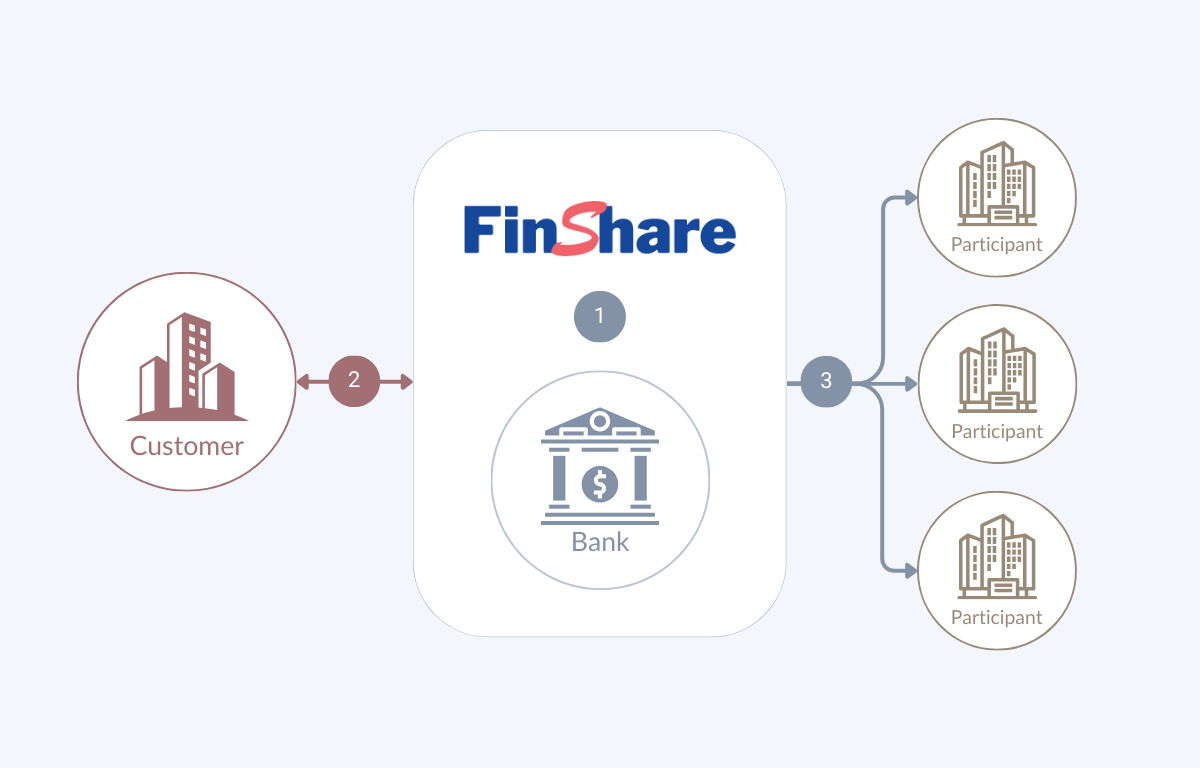

How Risk Participation Works

1

Lead Bank manages transactions.

2

Lead Bank has established relationship with Customer unchanged by Risk Participation agreements.

3

Participant purchases risk offered by parallel.

How FinShare Uses Risk Participation to Benefit You

Learn more below about how FinShare uses Risk Participation to benefit businesses and optimize financial health. FinShare's proprietary technology streamlines the Risk Participation process, making it faster and more efficient for businesses.

Additionally, FinShare offers personalized support and guidance to ensure that businesses are making the most of their financing options and optimizing their financial health.

Streamlined Risk and Relationship Management

FinShare supports the management and tracking of Risk Participation transactions along with other products with FinShare’s limit structure.

Configurable Eligibility Checks

FinShare automatically validates all transactions via syntax and duplication checks with configurable invoice and financing eligibility checks. Eligibility criteria can be based on stale period/age checks, min/max invoice amounts, currency, overdue checks etc.

Support for Funded and Unfunded Participation

FinShare caters to both funded and unfunded participation, providing flexibility to financial providers based on their specific requirements and risk appetite. This versatility allows participants to engage in various levels of financial support, ensuring compatibility with their funding capabilities and overall strategy.

Streamlined Automation for Calculations, Reports, and Notifications

FinShare streamlines and automates essential functions such as calculations, reporting, and notifications related to risk participation and syndication. This reduces manual efforts, improves efficiency, and ensures accuracy in the management and monitoring of risk participation activities, enhancing the overall user experience.

Ready to optimize your

Supply Chain and Trade Finance Solutions

Optimize your supply chain and trade finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us