Letter of Guarantee

A Letter of Guarantee (LG) is a formal commitment issued by a bank on behalf of its client, promising to pay a specified sum to a third party (the beneficiary) if the client fails to meet their contractual or financial obligations.

Book a Demo

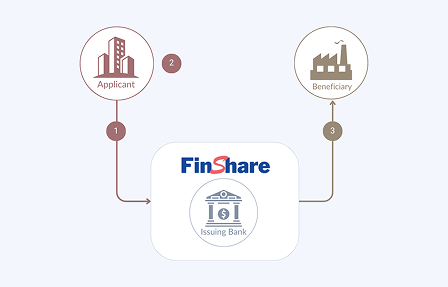

How Letter of Guarantee Works

1

Issuance: The applicant (e.g., a contractor or buyer) requests their bank to issue an LG in favor of the beneficiary.

2

Activation: Unlike an LC, which pays out upon successful delivery, an LG is only called upon if the applicant defaults or fails to perform.

3

Claim: If a breach occurs, the beneficiary submits a written demand to the bank, which then pays out the guaranteed amount.

How the Platform Strengthens Contractual Confidence with Letters of Guarantee

By supporting Letters of Guarantee on the platform, users benefit from a structured and transparent process for issuance, monitoring, and claim management. The platform centralizes guarantee details, validity tracking, and status visibility, enabling banks and beneficiaries to manage performance and credit risk more effectively. This allows parties to proceed with contracts confidently, even with new counterparties, while ensuring financial protection if contractual obligations are not met.

For Beneficiaries

Gain strong financial protection and peace of mind, knowing that contractual obligations are backed by a reputable bank. Letters of Guarantee reduce counterparty risk, ensure timely compensation in case of default, and enable confident engagement in high-value or long-term contracts.

For Applicants

Secure access to contracts and business opportunities without tying up working capital. A Letter of Guarantee preserves cash flow while signaling financial strength, reliability, and professionalism, enhancing credibility with partners, suppliers, and project owners.

For Banks

Strengthen client relationships by enabling critical transactions while maintaining controlled, clearly defined risk exposure. Letters of Guarantee generate fee-based income, support client growth, and reinforce the bank’s role as a trusted financial partner in complex commercial activities.

Ready to optimize your

Supply Chain and Trade Finance Solutions

Optimize your supply chain and trade finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us