Letter of Credit

A Letter of Credit (LC) is a formal financial document issued by a bank that guarantees a buyer's payment to a seller will be made on time and for the correct amount. It is primarily used in international trade to mitigate risks between parties who may not know each other and operate under different legal systems.

Book a Demo

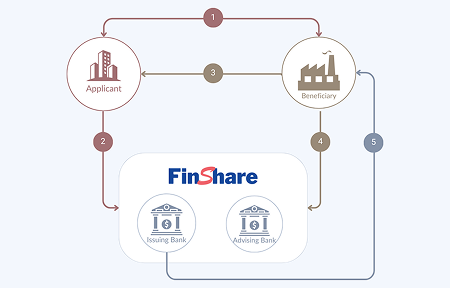

How Letter of Credit Works

1

Agreement: The buyer and seller agree to use an LC in their sales contract.

2

Issuance: The buyer (applicant) requests their bank (Issuing Bank) to open an LC in favor of the seller (beneficiary).

3

Shipment: The seller ships the goods and receives documents (like a bill of lading) as proof.

4

Presentation: The seller presents these documents to their bank (Advising Bank), which verifies them and sends them to the Issuing Bank.

5

Payment: If the documents strictly comply with the LC terms, the Issuing Bank releases payment to the seller.

How FinShare Streamlines Letter of Credit Transactions

Through Premium Technology’s FinShare platform, Letter of Credit processes are digitized and streamlined to improve speed, transparency, and control. The platform supports banks and businesses by simplifying document management, reducing manual intervention, and enabling better monitoring of trade transactions. As a result, banks can optimize operational efficiency, while buyers and sellers benefit from faster processing, reduced risk, and improved financial certainty throughout the trade lifecycle.

For Sellers

A letter of credit guarantees payment once delivery conditions are met, protecting the seller from non-payment or buyer bankruptcy. It provides financial certainty and improves cash-flow confidence. The bank’s guarantee reduces risk in international sales. This allows sellers to expand into new markets with greater assurance.

For Buyers

A letter of credit ensures payment is made only after proof of shipment is provided, protecting the buyer from delivery risk. It gives the buyer greater control over the transaction. The structured process encourages supplier reliability and compliance. This builds trust while maintaining strong financial oversight.

Ready to optimize your

Supply Chain and Trade Finance Solutions

Optimize your supply chain and trade finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us