Documentary Collection (D/C)

Documentary Collection (D/C) is a trade finance process where an exporter’s bank (Remitting Bank) acts as an intermediary to collect payment from an importer’s bank (Collecting Bank) in exchange for shipping documents.

Unlike a Letter of Credit, the banks do not guarantee payment; they simply act as facilitators to ensure that the buyer only receives the documents needed to claim the goods after they have either paid or formally promised to pay.

Book a Demo

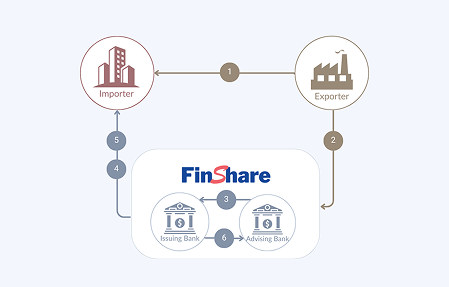

How Documentary Collection Works

1

Shipment: The exporter ships the goods and receives shipping documents (e.g., Bill of Lading).

2

Submission: The exporter sends these documents along with a "Collection Order" (payment instructions) to their bank.

3

Transmission: The exporter's bank forwards the documents to the importer's bank in the destination country.

4

Presentation: The importer's bank notifies the buyer that the documents have arrived and specifies the terms for their release.

5

Release: Depending on the agreed terms, the bank releases the documents to the buyer so they can clear customs and take possession of the goods.

6

Payment: The importer's bank transfers the funds back to the exporter's bank.

How Documentary Collection Is Supported on the Platform

By enabling Documentary Collection on the platform, trade participants benefit from a structured and transparent workflow for document submission, presentation, and payment handling. The platform digitizes and tracks each step of the collection process, improving visibility for exporters, importers, and banks while reducing manual coordination and processing delays. This allows parties to manage Documentary Collection transactions more efficiently, maintain document control, and support smoother settlement without the need for a bank payment guarantee.

For Exporters

Documentary Collections allow exporters to maintain control over the shipment by holding the key trade documents with the bank. Goods cannot be accessed or cleared by the importer until payment is made (D/P) or a legally binding promise to pay is accepted (D/A). This provides greater security than open account terms, while remaining cost-effective and operationally simple.

For Importers

Importers benefit from improved cash flow, as no advance payment is required. Payment or acceptance is made only after receiving verified shipping documents through the bank, providing assurance that goods have been dispatched as agreed. This reduces upfront risk while preserving trust and transparency in the trade transaction.

Ready to optimize your

Supply Chain and Trade Finance Solutions

Optimize your supply chain and trade finance offerings with our powerful and intuitive FinShare solution for streamlined operations and enhanced efficiency.

Contact Us